Whether you’re entertaining notions of buying or selling a home, you’re no doubt keeping up with housing news. And, what you’re seeing may concern you.

Doom and gloomers, naysayers and, curiously, even some experts are claiming that they are worried about the housing market.

The fact is, the real estate market is the one bright spot in the economy right now, and there are three reasons we can say this with confidence:

- Pending home sales

- Mortgage rates

- Consumer confidence

Let’s take these one-at-a-time and break it down for you.

Pending home sales

When a homebuyer signs an agreement to purchase, the home moves from an actively for-sale status to a pending status. It is sold, pending the outcome of the contract’s details. At any rate, it is no longer on the market.

“U.S. pending home sales are at their highest level since the middle of 2017,” according to Neil Dutta, former senior economist at Bank of America-Merrill Lynch for the U.S. and Canada.

Pending home sales are a “leading indicator” of the health of the housing market, Dutta says in an article at BusinessInsider.com.

Pending sales are up in all regions across the country.

On a side note, despite what you’ll read in the news about the slowing of new-home sales, they have increased 15 percent so far this year as well.

Mortgage rates

Mortgage applications for home purchases have increased roughly 15 percent from last year. This is proof-positive that a decrease in mortgage rates is most definitely stimulating the market.

Especially when one crunches the numbers, it’s easy to see that buying a home when rates drop may just beat the cost of renting. Plus, you’ll accumulate wealth in the process of owning the home.

“Let’s say you considered buying a $300,000 home on a 30-year mortgage in the fall, but held off,” explains Gretchen Frazee, deputy digital editor for PBS NewsHour.

“If you were to buy the same house now, the interest rate drop could decrease your monthly payments by $160 per month and save more than $60,000 over the life of the loan,” she concludes.

Consumer confidence

Consumer confidence is measured by a number of governmental offices and universities. The University of Michigan, for instance, recently released its August consumer confidence poll which showed consumer sentiment, overall, declining.

Keep in mind when you read news about consumer confidence that it is a measurement of confidence in the economy as a whole.

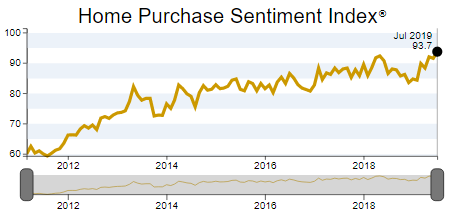

Fannie Mae publishes the Home Purchase Sentiment Index which focuses solely on consumer confidence in the housing market. That is the measurement to watch when you’re keeping tabs on the real estate market as a consumer.

“According to the Conference Board, buying intentions for new homes have exploded to levels not seen since before the financial crisis,” claims Dutta. And, he is correct.

So, while journalists and other non-real estate professionals spread doom and gloom about the housing market, as you can see by Fannie Mae’s graph, consumers are feeling the opposite.

What about the predicted recession?

The U.S. economy, or “business cycle” includes four phases:

- Expansion

- Peak

- Recession

- Trough

Our economy’s “natural state” is expansion, where we experience robust sales, consistent wage growth, increasing GDP and low unemployment rates.

Many economists are saying we’ve reached the peak of the current economic cycle which typically lasts 10 years, so we’re long overdue for a recession.

Don’t allow recession talk to frighten you out of realizing your real estate plans, whether that means buying or selling a home.

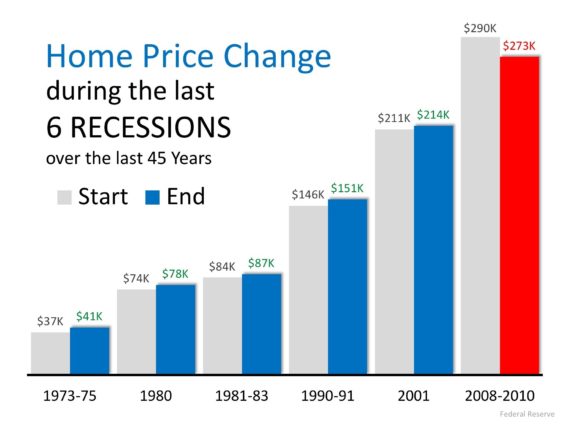

Especially if you hope to sell this year or next, you’ll be happy to know that in all but one recession in recent history, homes actually sold for more than they did before the downturn in the economy.

None of the top economists who are predicting an oncoming recession blame it on the housing market (which played a large part in the 2008-2010 recession), so it should survive, relatively unscathed.

It’s important to keep in mind that, right now, the market is in the process of normalizing, coming down from the heady sellers’ market of the past few years.

Take a deep breath, ignore the doomsayers and continue on with your real estate plans.